401k Maximizer & ETF Maximizer

If you are a Delta employee we encourage you to sign up for the DELTA 401k Maximizer newsletter in order to gain a better understanding out how the 401k Maximizer system works. If you are a DELTA emloyee; this is the newsletter for you. This newsletter provides monthly recommendations for the DELTA retirment plans.

There are other services available to manage my Delta Airlines 401k retirement plans, what makes your system better?

That's a great question. There are two main issues you want to consider when managing your retirement portfolios. The first is a method to show you when it's safe to be fully invested, partially invested or out of the market entirely in the safety of cash and the second is a thoroughly tested fund selection system.

We say managing because each of us should be actively upgrading our retirement holdings monthly to the best performing funds if you want to outperform the market over the long term. Buy and hold asset allocation is a recipe for under performance whether it's with your retirement portfolio or with other dollars. Look at it this way, on Wall Street money is constantly rotating from sector to sector and industry to industry. Normally, when the market favors a certain area like oil stocks, or biotech, or international stocks those areas will start to trend, and trend, and trend, for months on end. If the funds you bought to hold 2 years ago don't hold the kind of stocks that are being favored by large institutional investors at the time then they will languish month after month under performing the major indexes and occasionally even lose money when the rest of the market is going up. This is why it's critically important to constantly upgrade your holdings to the funds which are outperforming others over the recent past in order to focus your investments in those funds which are holding the stocks that the major institutions are accumulating at the time.

Before jumping into the market though you want to analyze overall market conditions to determine whether the market currently has a positive or negative bias. The 401k Maximizer Major Market Analysis tells investors whether it's safe to be fully invested or partially invested in the safety of cash or cash equivalents as we walk forward in time.

The bottom line is that there are times when even the most aggressive investors should pursue a conservative portfolio and conversely there are times when even the most conservative investors should be aggressively invested in the market. Our goal is to guide you with a clear perspective about what kind of environment we are in so that you can adjust your portfolio through time.

This whole issue is so important it forms the backbone of the 401k Maximizer. At 401k Maximizer we look at 7 different measures of underlying market internals, sometimes referred to as market breadth, of both the NASDAQ and the NYSE to determine how aggressive our fund recommendations should be. These market internals gauge the strength of both the NASDAQ's and NYSE's up volume, down volume, advancing issues, declining issues, accumulation, distribution, and trend strength on a weekly basis. All of this information forms a consensus pointing to either a positive or negative market bias displayed by one simple indicator for each index. We show both of these indicators to our subscribers in every newsletter.

These indicators drive our recommendations about whether it's safe to be fully invested or partially invested in the safety of cash or a cash equivalent at the time.

The second key component of any successful method to manage retirement funds with is a fund selection system. 401k Maximizer uses a ranking method based upon each fund's multi-period weighted returns. This approach is considered one of the most robust mutual fund selection techniques available and has been used very successfully for years by professional money management firms specializing in mutual fund up-grading.

Which investment method is best for me?

Risk vs. Reward

The Aggressive method remains 100% invested in the best ranked funds on a rolling month to month basis. This allows investors who don't like adjusting their market exposure to account for current market conditions, to stay invested in the highest ranked funds. In most market conditions, short of a bear market, the Aggressive method will probably outperform the Moderate and the Conservative risk approaches, but not by a lot, and clearly not enough so that subscribers approaching retirement, or in retirement, or subscribers who just don't want to see their account values decrease a lot from their peak values should follow the Aggressive approach.

Conservative and Moderate risk portfolios reduce their market exposure by holding fewer funds to lower portfolio volatility when the bias of the market becomes negative.

There are several other value added features of the 401k Maximizer system that you'll want to carefully consider, including:

* Ease of Use

* Clear, user friendly, presentation

* Specific Recommendations for Conservative, Moderate and Aggressive investors

* Different market exposure level recommendations for Conservative, Moderate and Aggressive investors when market conditions and bias deteriorate.

* 401k Maximizer uses the actual price data for each available fund. The market index data is from FastTrack.

* Recommendations are made before the end of the month. Additionally we monitor the markets daily and if it is necessary we will send you an urgent mid-month set of recommendations.

Why spend all the time upgrading my 401k holdings every month? I feel more comfortable just buying and holding 2 or 3 good funds.

One of the golden nuggets of your retirement plans is the ability to upgrade to the best performing funds monthly without worrying about short term capital gains taxes and the commissions you incur in a retail account. Consider this, the commission to buy and sell a fund from a low cost broker outside of the retirement plan might run $25 to $50 per month every time you made a change. Then multiply this 4 or 5 if you hold 4 to 5 funds at a time and you can see how expenses can kill your performance very quickly.

To see the real power of constantly upgrading to the best performing funds on a rolling month to month basis let's compare similar gains in the market with a buy and hold system versus an upgrade system. Hypothetically, we're going to make 2 investments. In our first investment we buy fund ABC at the beginning of the year and hold it for the entire year. This, buy and hold strategy gives us a return of 20% for the year, a great return! With our second investment we buy fund ABC at the beginning of the year and then sell it several months later with an 8% gain. Our model now says to buy fund DEF which we purchase and hold for a 7% gain. Next, the model says to buy fund GHI which we hold for a -2% loss. Finally, our model says to buy fund JKL which we hold to the end of the year for a 7% gain. Now by the end of the year our upgrading has produced what appears to be a similar 20% gain = +8%, +7%,-2%, +7% but in reality we made more money than buy and hold. Our buy and hold approach gained 20% but our upgrading produced a yearly gain of 21.18%!!

How did this happen? It's because when we continually upgrade to the best performing funds throughout the course of a year we are constantly leveraging our gains from the previous investment into our new investment. To make this clearer from the example above after our first gain of 8% a $100 starting value is now worth $108. So when we make the next purchase with a gain of 7% we are realizing a gain of 7% on our original $100 investment plus a gain of 7% on the $8 gain from the first investment. Remember that our account had grown to $108 before we made the second investment. And when you do that over and over and over again throughout the year you leverage your gains with the power of compounding again and again. It's that power of compounding gains over and over again that is the magic golden nugget of monthly upgrading. Albert Einstein referred to the power of compounding as the 8'th wonder of the world and when you see it in practice you have to agree that not only does E = M*C*C but that compounded gains are magical!

How do I use your system?

It's easy. Just subscribe and you will receive an email message during the last week of each month announcing that new recommendations are available. This message will prompt you as a subscriber to log into the 401k Maximizer web site and Sign In. Once you have signed in you are able to download the next month's newsletter. We publish the newsletter on the last weekend of every month in order to give subscribers time to re-allocate to the new recommendations before the beginning of the new month. 401k Maximizer is also published during the course of the month if any significant market changes have occurred which would warrant an increase or decrease in market exposure. If you do not receive an email message towards the end of each month, you can always visit the web site and Sign In to see if new recommendations have already been posted.

The key is to stay with the trend constantly up-grading to the best performing funds.

Notes: The information and data contained herein are compiled from what we believe are the most appropriate sources available and are believed to be reliable, but accuracy cannot be guaranteed. 401k Maximizer, Inc. disclaims any and all liability for losses that may be sustained as a result of using the data presented herein. Past performance is no assurance of future results. All investments involve risk. You should invest only after careful examination of fund prospectuses.

401k Maximizer, Inc. monitors fund performance and publishes a monthly newsletter. The goal of 401k Maximizer is to take the guess work out of the 401k choices and to help every employee manage his or her own 401k plan. 401k Maximizer is a newsletter monitoring the 401k investment alternatives available to employees of Delta Airlines. Delta Airlines is a registered trademark.

401k Maximizer, Inc. specializes in developing superior systems for managing retirement plan assets.

If you are a Delta employee we encourage you to sign up for the DELTA 401k Maximizer newsletter in order to gain a better understanding of how the 401k Maximizer system works. If you are a DELTA employee, this is the newsletter for you. This newsletter provides monthly recommendations for the DELTA Airlines retirement plans for both pilots and non-pilots.

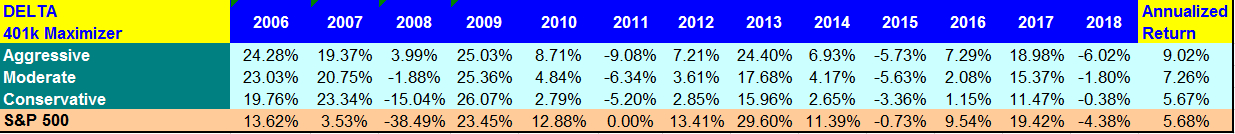

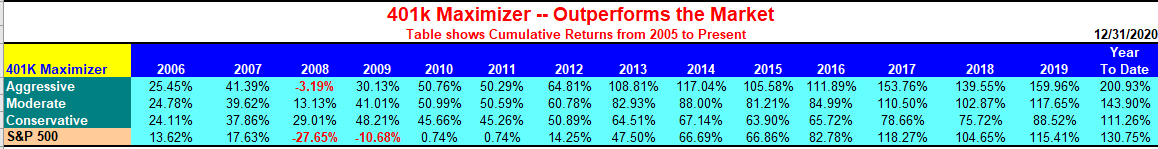

There are many benefits to our recommendations. For example, a big benefit is that when markets drop like they did in 2008 our systems outperform. In fact during that time the S&P was down by 38% while our DELTA Aggressive recommendations made money. Quite an outstanding feat -- and a clear example of the value of solid analytic based investing.

For those subscribers who take advantage of Delta's brokerage window giving you the opportunity to purchase other securities outside of the funds in the Delta plans, 401 Maximizer publishes the ETF Maximizer Newsletter.

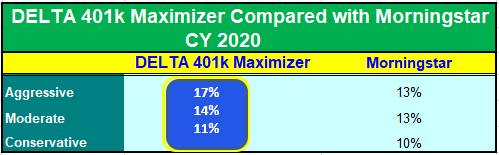

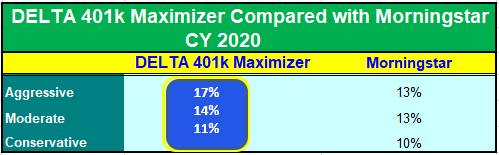

Here are the results for the last 13 years of the DELTA 401k Maximizer Portfolios. Our published recommendations started in 2010.

It’s easy to get started, just visit www.401kMaximizer.com and click on Subscriber Now.

trademark.

Delta Airlines - Introduction

The 401k Maximizer newsletter for Delta Airlines was developed so that employees at Delta Airlines can have a powerful, easy tool to build a secure retirement.

401k Maximizer solves 401k fund selection decisions with easy to follow model portfolios. 401k Maximizer shows you how to grow your retirement account and minimize losses that threaten your retirement by upgrading your fund holdings on a monthly basis.

How many times have we witnessed colleagues working weekends, holidays or all night shifts just to pick up a few extra dollars in after tax earnings? And yet many of those hard workers won't take 5 minutes a month to manage their retirement accounts. Remember, that retirement dollars are all tax deferred while salaries are taxable. So do yourself, and your family, a favor and make it a habit to spend the 5 minutes every month it takes to keep your tax deferred retirement investments in the best performing funds.

When do you Upgrade?

The 401k Maximizer newsletter is published either on or close to the 1’st of every month. The newsletter features model portfolios for Conservative, Moderate and Aggressive risk investors. Upgrading your holdings on a monthly basis gives you the opportunity to seek the safety of fix income and more conservative fund choices during periods of market volatility while staying invested in equity funds during bullish market conditions.

The power of this approach is so effective that you will soon be telling other employees you work with about the difference it has made in your retirement plan since you subscribed. Remember that a secure retirement is one of the greatest gifts you can give yourself. Don't hesitate, subscribe now and start turning your tax deferred retirement dollars into the retirement security they are meant to be.

Brokerage Link Options

The 401k Maximizer model portfolios are for the funds internal to the plan, but the newsletter also features a Fidelity portfolio of no transaction fee Exchange Traded Funds that subscribers can invest in using the Fidelity Brokerage Link window. This is a great way to diversify your investments and take advantage of opportunities outside of the funds internal to the plan.

Top Down Investing

At 401k Maximizer, we approach the market from a top down perspective. First we evaluate overall market conditions in order to determine whether there is more potential for gains or risk to the downside in the next month.

One of the value added features in the newsletter every month is our Market Analysis section. The Market Analysis helps us gage the overall bias of the market evaluating several underlying measures of market breadth of both large cap stocks as represented by the S&P 500 index and technology stocks as represented by the NASDAQ Composite index. The easy to read charts showing the markets bias are a product of 7 different measurements of price direction, accumulation vs. distribution, and several other measures of underlying market breadth. The charts showing market bias represent a consensus vote of all of the underlying indicators which drive them. The consensus of the vote shows us the positive or negative bias of the market. We look at these indicators using weekly bars of market change to dampen out short term market noise and gain a clear picture of actual market bias.

When the consensus of all 7 underlying measures of the S&P 500 and the NASDAQ Composite turns negative you will see the model portfolios upgrading to more conservative holdings. This is one of the reasons why our subscribers did so well during the last bear market in 2008.

Fund Selections

So how do we select our monthly fund recommendations? First of all, it's important to remember that the funds in the 401k plan which will produce the greatest returns will slowly change during the course of a year. This is why we want to upgrade our portfolios monthly to stay invested in the funds which have the greatest potential for gains in the following month. The fund recommendations are a product of a proprietary ranking process that considers each funds recent and historical returns. This approach is considered one of the most robust mutual fund selection techniques available.

Summary - The Advantages of using 401k Maximizer, Inc. as your guide to 401k plan fund selection

- We start with a top down analysis of the overall market and use advanced multiple measures of underlying market breadth and strength driven by 7 different proprietary indicators all voting against each other to determine the markets bias.

- This market bias determines the level of market risk which in turn drives fund selection considerations of the model portfolios.

- We rank all of the 401k plan funds using a thoroughly tested methodology that weighs each fund's recent and longer term returns.

- To summarize, our goal is to always position ourselves for the greatest returns based upon the current market conditions with the understanding that once in a great while the greatest returns may be the safety of cash in a money market fund.

Notes: The information and data contained herein are compiled from the Delta Airlines web sites and other sources and are believed to be reliable, but accuracy cannot be guaranteed. 401k Maximizer, Inc. disclaims any and all liability for losses that may be sustained as a result of using the data presented herein. Past performance is no assurance of future results. All investments involve risk. You should invest only after careful examination of fund prospectuses.

401k Maximizer, Inc. monitors fund performance and publishes a monthly newsletter. The goal of 401k Maximizer is to take the guess work out of the fund choices and to help every employee manage his or her own retirement plan. 401k Maximizer is a newsletter monitoring the retirement fund alternatives available to employees of Delta Airlines.

Performance

The two tables below show model portfolio from 2006 thru 2018, not the column on the right showing annualized returns over the entire period of time.

The first table shows the historical performance of the fund selections for the funds internal to the plan.

The next table shows the portfolio returns using Fidelity commission free funds available using the brokerage window.

401k Maximizer, Inc. specializes in developing superior systems for managing retirement plans.

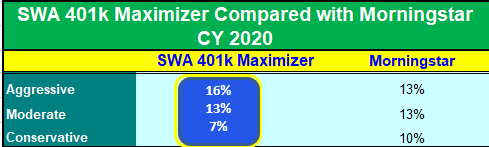

If you are a Southwest Airlines employee, we encourage you to sign up for the SWA 401k Maximizer newsletter in order to gain a better understanding of how the 401k Maximizer system works. If you are an SWA employee, this is the newsletter for you. This newsletter provides monthly recommendations for the AA retirement plans for both pilots and non-pilots.

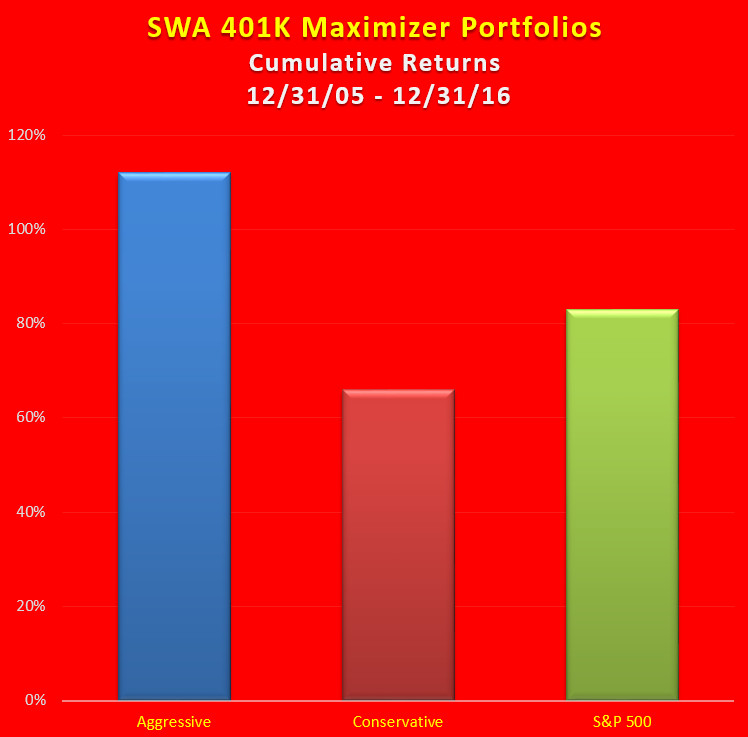

A big benefit of the newsletter is that this consistent investing method has outperformed the markets cumulatively for over 11 years. As shown in the cumulative chart and table below, both the Aggressive and Moderate recommendations have made more money over the years than investing in the S&P 500.

It’s easy to get started, just visit www.401kMaximizer.com and click on Subscriber Now.