Delta Airlines - Introduction

Delta Airlines - Introduction

The 401k Maximizer newsletter for Delta Airlines was developed so that employees at Delta Airlines can have a powerful, easy tool to build a secure retirement.

401k Maximizer solves 401k fund selection decisions with easy to follow model portfolios. 401k Maximizer shows you how to grow your retirement account and minimize losses that threaten your retirement by upgrading your fund holdings on a monthly basis.

How many times have we witnessed colleagues working weekends, holidays or all night shifts just to pick up a few extra dollars in after tax earnings? And yet many of those hard workers won't take 5 minutes a month to manage their retirement accounts. Remember, that retirement dollars are all tax deferred while salaries are taxable. So do yourself, and your family, a favor and make it a habit to spend the 5 minutes every month it takes to keep your tax deferred retirement investments in the best performing funds.

When do you Upgrade?

The 401k Maximizer newsletter is published either on or close to the 1’st of every month. The newsletter features model portfolios for Conservative, Moderate and Aggressive risk investors. Upgrading your holdings on a monthly basis gives you the opportunity to seek the safety of fix income and more conservative fund choices during periods of market volatility while staying invested in equity funds during bullish market conditions.

The power of this approach is so effective that you will soon be telling other employees you work with about the difference it has made in your retirement plan since you subscribed. Remember that a secure retirement is one of the greatest gifts you can give yourself. Don't hesitate, subscribe now and start turning your tax deferred retirement dollars into the retirement security they are meant to be.

Brokerage Link Options

The 401k Maximizer model portfolios are for the funds internal to the plan, but the newsletter also features a Fidelity portfolio of no transaction fee Exchange Traded Funds that subscribers can invest in using the Fidelity Brokerage Link window. This is a great way to diversify your investments and take advantage of opportunities outside of the funds internal to the plan.

Top Down Investing

At 401k Maximizer, we approach the market from a top down perspective. First we evaluate overall market conditions in order to determine whether there is more potential for gains or risk to the downside in the next month.

One of the value added features in the newsletter every month is our Market Analysis section. The Market Analysis helps us gage the overall bias of the market evaluating several underlying measures of market breadth of both large cap stocks as represented by the S&P 500 index and technology stocks as represented by the NASDAQ Composite index. The easy to read charts showing the markets bias are a product of 7 different measurements of price direction, accumulation vs. distribution, and several other measures of underlying market breadth. The charts showing market bias represent a consensus vote of all of the underlying indicators which drive them. The consensus of the vote shows us the positive or negative bias of the market. We look at these indicators using weekly bars of market change to dampen out short term market noise and gain a clear picture of actual market bias.

When the consensus of all 7 underlying measures of the S&P 500 and the NASDAQ Composite turns negative you will see the model portfolios upgrading to more conservative holdings. This is one of the reasons why our subscribers did so well during the last bear market in 2008.

Fund Selections

So how do we select our monthly fund recommendations? First of all, it's important to remember that the funds in the 401k plan which will produce the greatest returns will slowly change during the course of a year. This is why we want to upgrade our portfolios monthly to stay invested in the funds which have the greatest potential for gains in the following month. The fund recommendations are a product of a proprietary ranking process that considers each funds recent and historical returns. This approach is considered one of the most robust mutual fund selection techniques available.

Summary - The Advantages of using 401k Maximizer, Inc. as your guide to 401k plan fund selection

- We start with a top down analysis of the overall market and use advanced multiple measures of underlying market breadth and strength driven by 7 different proprietary indicators all voting against each other to determine the markets bias.

- This market bias determines the level of market risk which in turn drives fund selection considerations of the model portfolios.

- We rank all of the 401k plan funds using a thoroughly tested methodology that weighs each fund's recent and longer term returns.

- To summarize, our goal is to always position ourselves for the greatest returns based upon the current market conditions with the understanding that once in a great while the greatest returns may be the safety of cash in a money market fund.

Notes: The information and data contained herein are compiled from the Delta Airlines web sites and other sources and are believed to be reliable, but accuracy cannot be guaranteed. 401k Maximizer, Inc. disclaims any and all liability for losses that may be sustained as a result of using the data presented herein. Past performance is no assurance of future results. All investments involve risk. You should invest only after careful examination of fund prospectuses.

401k Maximizer, Inc. monitors fund performance and publishes a monthly newsletter. The goal of 401k Maximizer is to take the guess work out of the fund choices and to help every employee manage his or her own retirement plan. 401k Maximizer is a newsletter monitoring the retirement fund alternatives available to employees of Delta Airlines.

Performance

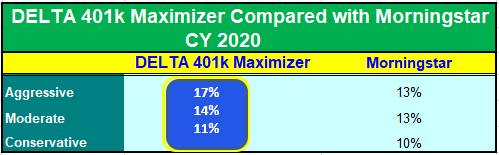

The two tables below show model portfolio from 2006 thru 2018, not the column on the right showing annualized returns over the entire period of time.

The first table shows the historical performance of the fund selections for the funds internal to the plan.

The next table shows the portfolio returns using Fidelity commission free funds available using the brokerage window.