401k Maximizer & ETF Maximizer

Most people are not taking advantage of the opportunity to build wealth in their self directed retirement accounts. One of your best assets is languishing and dying on the vine because you are too busy or aren't sure about what to do with it.

Both 401k Maximizer and ETF Maximizer are powerful, easy-to-use newsletters to help the individual investor manage self directed retirement dollars. The ETF Trading System, ETF Maximizer, was developed for investors desiring to manage their accounts using Exchange Traded Funds.

Every one should take advantage of the tax deferred power of retirement savings plans. But most of us just don't know what to invest in and how to limit our risk when the market turns down. Finally, there is a powerful tool to address this problem using 401K Maximizer and ETF Maximizer recommendations.

During the last week of every month 401k Maximizer and ETF Maximizer show you which funds to purchase and how much exposure Conservative, Moderate and Aggressive investors should have in the market for the following month. Then daily we analyze the risk/reward potential of the overall market and let you know if any significant changes have occurred which would warrant a reduction or increase in your market exposure.

If you are an employee of American Airlines, Southwest, or Delta, we have the right newsletter for you. Or if you wish to manage an account outside of your airlines retirement plan you can also use the ETF Maximizer.

To get started managing your retirement funds click on the appropriate link above and then on “Subscribe Now”.

The 401k Maximizer by 401k Maximizer, Inc. was developed exclusively for the American Airlines Super Saver 401K Plan.

The 401k Maximizer was developed so that every employee at American Airlines can have a powerful, easy tool to manage their 401K dollars. The 401k Maximizer solves 401K fund selection decisions immediately. Every employee should be taking advantage of the tax deferred power of our 401K Plan, but most of us just don't know how to maximize our returns and limit our risk when the market turns down. The 401k Maximizer will show you how to grow your 401K account and avoid losses that threaten your retirement. 401k Maximizer gives busy employees the bottom line on what to do with their 401K account, so they can build a secure retirement and not worry about their money.

How many times have we all witnessed colleagues of ours working weekends, holidays or all night shifts just to pick up a few extra dollars in after tax money. And yet those same folks won't take 5 minutes a month to manage their 401k accounts which will have a far greater impact on their financial future than those few extra hours every month on the job. Remember, that our 401k dollars are all tax deferred and our salaries are taxable. So do yourself, and your family, a favor and make it a habit to spend the 5 minutes every month it takes to re-allocate those 401k dollars.

During the last week of every month we will show you which funds to own, and how much exposure Conservative, Moderate and Aggressive investors should have in the market, the following month. Then every day we analyze the risk/reward potential of the overall market and let you know if any significant changes occur which would warrant you to reduce or increase your 401K market exposure and how. Stay safely on track toward reaching a secure retirement. This service will show you when to avoid high-risk times in the markets and times when the odds for solid growth are in your favor. Then it's just a matter of following the fund recommendations.

The power of this approach is so effective that you will soon be telling other employees you work with about the difference it has made in your 401K plan since you signed up. Because every American Airlines employee deserves the peace of mind of a secure retirement we want each of you to maximize your 401K investment returns. A secure retirement is one of the greatest gifts you can give yourself. Don't hesitate, subscribe now and start turning your tax deferred retirement dollars into the retirement security 401k plans were meant to be.

Top Down Investing

At 401k Maximizer,Inc. we approach the market from a top down perspective. First we evaluate overall market conditions to evaluate the risks in the market which will determine the level of market exposure Conservative, Moderate and Aggressive risk investors want their portfolios to have in the next month.

To demonstrate the power of analyzing overall market conditions before investing our hard earned 401K dollars let's compare the returns you would have realized using a simple 50 day moving average of the NASDAQ and S&P 500 indexes to evaluate whether it's safer in the market our out of the market, in the safety of cash (or in our case the credit union), during the period from 1972 to 1993.

For the S&P 500, buy and hold from 1972 to 1993 would have returned 349.96%, compared to 533.21% using a 50 day moving average to get in and out of the market. With the NASDAQ, buy and hold would have returned 760.74%, compared to 6,016% with timing.

If you had started out with $10,000, buy and hold would have increased that amount to $44,996 on the NYSE and $86,074 on the NASDAQ. Using a simple 50day moving average would have increased those numbers to $63,321 on the NYSE and $611,686 on the NASDAQ.

If you had bought and held the Dow Industrials from 1970 to 1994, you would have gained 472.62%. If you missed the 75 best days, you would have lost 51.56% of your money. But if you had missed the 75 worst days, you would have made 5,187%!!

We were so fascinated by this at 401k Maximizer, Inc. that we took it all the way back to 1928 and found that if you had purchased the Dow Jones industrial average index with $10,000 in 1928 and held it until the end of 2002, that $10,000 would have to grow to $330,807. If you had missed the 10 best months in the market since 1928, we're only talking about 10 months here in close to a 900 month period, then that $10,000 would have only grown to $47,387. But if you had missed the 10 worst months in the market since 1928 that initial $10,000 value would have grown to $3,713,036!! So it definitely pays to be in the safety of cash during the worst periods in the market, as most of you know who rode the market down during 2000 through the winter of 2002. The easy conclusion of all of this testing is that the key to making big profits over the long term is to avoid the market altogether during big sell offs.

Market Analysis

So how do we determine whether it's safe or not to dip our toes into the market at any given time? Well after many years of testing; back testing, forward testing, and just all around crazy testing we have found that relying upon any one indicator, like a moving average, or even two moving averages, is a very dangerous way to approach the market. Why? Because even the best indicators breakdown at times and don't work!!

So when you have your hard earned dollars on the line it's wiser to take a consensus of some of the best market barometers available to determine whether the wind is at your back or pushing you back. Consequently, our market analysis of both the large cap stocks as represented by the S&P 500 stocks or small cap stocks as represented by the Nasdaq Composite is a product of 7 different measurements of price direction, accumulation vs. distribution, and several measures of underlying market breadth. Each of these major signals represents a consensus vote of all of the underlying indicators which drive them. The consensus of the vote shows us the positive or negative bias of the market. Consequently, if any indicator, like a moving average, breaks down and stops performing for a period of time, its failure is masked by the consensus of the other indicators, which are still performing. We look at these indicators using weekly bars of market change to dampen out short term market noise and gain a clear picture of actual market bias.

When the consensus of all 7 underlying indicators of both the S&P 500 and the Nasdaq Composite turn negative we recommend that Conservative and Moderate risk investors reduce their market exposure. Because as the losses everyone took during the bear market show, there are times when it's just better to have money invested in the safety of cash than watch it dwindle away in any investment.

Fund Selection

So how do we select our monthly recommendations? First of all, it’s important to remember that the Super Saver fund selections producing the greatest returns will slowly change during the course of a year. This is why we want to upgrade our portfolios monthly to stay invested in the funds which have the greatest potential for gains in the following month. To select those funds, we evaluate multiple measures of each of the funds returns. This is a proprietary ranking process which considers each funds recent and historical returns. This approach is considered one of the most robust mutual fund selection techniques available.

Summary

The Advantages of using 401k Maximizer, Inc. as your guide to Super Saver fund selection:

- We start with a top down analysis of the overall market and use advanced multiple measures of underlying market breadth and strength driven by 7 different proprietary indicators all voting against each other to determine the markets bias.

- This market bias determines the level of market risk which in turn drives the level of market exposure that Aggressive, Moderate, and Conservative risk investors want to have on a month to month basis.

- We rank all of the Super Saver funds using a thoroughly tested methodology that weighs each fund’s recent and longer term returns.

To summarize, our goal is to always position ourselves for the greatest returns based upon the current market conditions with the understanding that once in a great while the greatest returns may be the safety of cash in the credit union fund.

Notes: The information and data contained herein are compiled from the J.P. Morgan web site and other sources and are believed to be reliable, but accuracy cannot be guaranteed. 401k Maximizer, Inc. disclaims any and all liability for losses that may be sustained as a result of using the data presented herein. Past performance is no assurance of future results. All investments involve risk. You should invest only after careful examination of fund prospectuses.

401k Maximizer, Inc. monitors fund performance and publishes a monthly newsletter. The goal of 401k Maximizer is to take the guess work out of the 401k choices and to help every employee manage his or her own 401k plan. 401k Maximizer is a newsletter monitoring the 401k investment alternatives available to employees of American Airlines, American Eagle and other employees of AMR Corp. American Airlines is a registered trademark of AMR Corp.

Performance

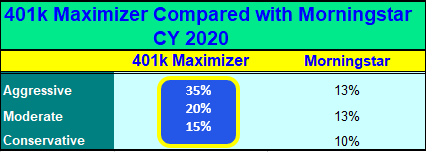

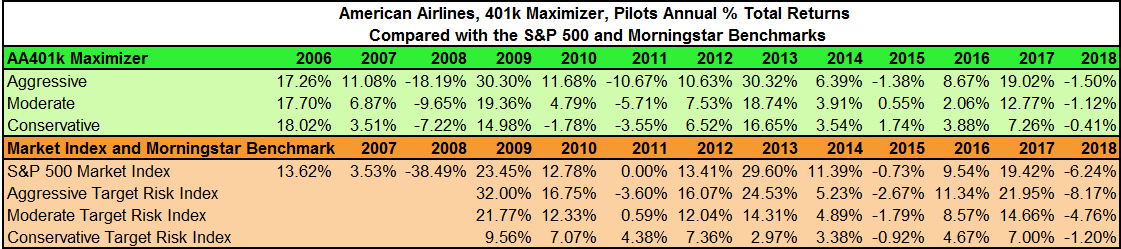

401k Maximizer has published the AA 401k Maximizer Newsletter every month since the beginning of 2006. While past performance does not guarantee future performance our record has been excellent and has provided long-term superior results.

If you are a Delta employee we encourage you to sign up for the DELTA Airlines 401k Maximizer newsletter in order to gain a better understanding out how the 401k Maximizer system works. If you are a DELTA emloyee; this is the newsletter for you. This newsletter provides monthly recommendations for the DELTA Airlines retirement plans.

We provide three investing methods for you to choose from depending on your risk tolerance and objectives. Each is described below.

The 401kMaximizer Conservative Method

This approach is 100% invested in the market whenever the bias of either the NASDAQ Composite or the S&P 500 are neutral or positive. Our historical testing and real time results show that this approach will produce smaller gains than the Aggressive method when the overall market is trending sideways or up. Subscribers approaching retirement, or in retirement, or subscribers who just don’t want to see their account values decrease a lot from their peak value should carefully consider following this approach as it’s the easiest approach to live with as the market goes through different cycles.

The Conservative risk Method reduces your market exposure by two thirds whenever the bias of both the NASDAQ and S&P 500 market indexes turns negative.

The Conservative risk investment method will vary your exposure to the market as the risk in the market changes over time. We measure market risk with the buy and sell counts. The buy and sell counts measure the bias and therefore the risk of both the NASDAQ and S&P 500 markets. These are described in further detail in both the Introduction and FAQ's section of the web site.

The 401kMaximizer Moderate Method

This approach is 100% invested in the market whenever the bias of either the NASDAQ Composite or the S&P 500 are neutral or positive. Our historical testing and real time results show that this approach will produce smaller gains than the Aggressive method when the overall market is trending sideways or up, but not by a lot.

The Moderate risk Method reduces your market exposure by a third whenever the bias of both the NASDAQ and S&P 500 market indexes turn negative.

The Moderate risk investment method will vary your exposure to the market as the risk in the market changes over time. We measure market risk with the buy and sell counts. The buy and sell counts measure the bias and therefore the risk of both the NASDAQ and S&P 500 markets. These are described in further detail in both the Introduction and FAQ's section of the web site.

The 401kMaximizer Aggressive Method

This method is always 100% invested in the top ranked funds each month. This approach has the most risk of all of the three approaches but will in all likelihood outperform the other two approaches over time although with a lot more volatility.

This approach has the greatest amount of risk because it is invested in the market 100% of the time.

The Aggressive risk investment method is for folks who want to have 100% exposure to the markets at all times. It will have the highest draw downs of the three methods but historical testing and real time results show that it will prospectively have the highest returns as long as the overall major market indexes trend sideways or up.

Notes: The information and data contained herein are compiled from what we believe are the most appropriate sources available and are believed to be reliable, but accuracy cannot be guaranteed. 401k Maximizer disclaims any and all liability for losses that may be sustained as a result of using the data presented herein. Past performance is no assurance of future results. All investments involve risk. You should invest only after careful examination of fund prospectuses.